USDC has almost always been the dominant stablecoin on Ethereum and is the stablecoin of choice for the majority of DeFi protocols. Over the past year the marketcap of USDC on Ethereum has increased from 22b to 36b (+64%). The risk of having a centralized stablecoin as a primary asset in a decentralized ecosystem has largely been ignored as its adoption grew. Even the most popular decentralized stablecoin, DAI, has over a third of its collateral in USDC.

Lately, however, the risks of centralized stablecoins have become more pressing, leading to the rise of protocol native stablecoins.

What are Protocol Native Stablecoins?

Though there is no official definition of a “protocol native stablecoin”, I would classify it as the recent trend seen of DeFi protocols creating their own stablecoin while it is not their primary application. Other protocol issued stablecoins such as DAI, FRAX, and MIM would not be considered protocol native stablecoins as their express application is their stablecoin. Centralized stablecoins such as USDC are not issued by a protocol and thus are not considered a protocol native stablecoin.

sUSD

A protocol native stablecoin that has existed for a long time now is sUSD, with a supply of 170m making it the 15th largest stablecoin. sUSD is the protocol native stablecoin of Synthetix, a derivatives platform specializing in synthetic assets. sUSD is a fully collateralized stablecoin and is able to be minted on the protocol using SNX. SNX stakers can also earn yield in the form of sUSD from the fees generated by the protocol.

DPXUSD

Another protocol native stablecoin that is currently in the works called DPXUSD, the planned stablecoin of Dopex, a derivatives platform specializing in options. DPXUSD will be fully collateralized by LP positions of the protocol’s native assets of DPX and rDPX. This protocol native stablecoin was first announced in March 2022 and recently Tetranode on the NIA podcast has said that it is about to come out.

Curve, AAVE, and GHO

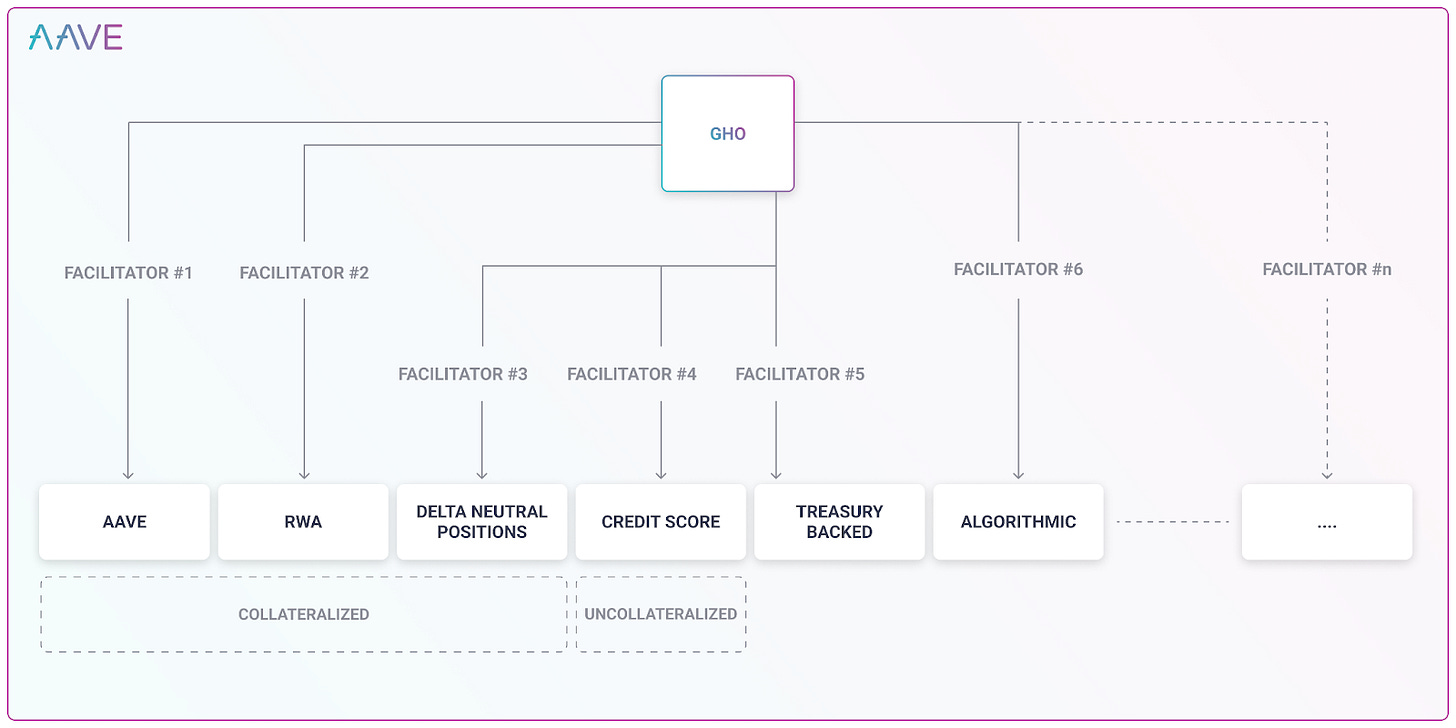

More recently, in July, two of the largest DeFi protocols have also announced their own protocol native stablecoins, Curve (5.7b TVL) and AAVE (6.3b TVL). Curve’s stablecoin plans to be overcollateralized, but not much additional information has been given on it. AAVE’s stablecoin, GHO, has already been discussed and voted on with a 99.99% approval. GHO plans to be collateralized with several different “facilitators” being able to mint or burn (redeem for the collateral back) GHO. Some of these facilitators include AAVE, real world assets, and even potentially a credit score allowing for uncollateralized minting of GHO.

Why Protocol Native Stablecoins?

The rise of these protocol native stablecoins can be attributed to both the downside of using centralized stablecoins, the benefit of having a native stablecoin, and the ability to capture a share of an evergrowing market.

Downside of Centralized Stablecoins

The reliance of centralized stablecoins such as USDC is extremely dangerous for DeFi as they have the ability to be frozen, and gives a large amount of power to these centralized parties. A reliance on these stablecoins makes much of DeFi susceptible to censorship. For example, if the USDC collateral for large protocols were suddenly frozen due to them no longer being accepted by the feds, entire ecosystems could collapse due to the sudden void of collateral. By moving away from centralized stablecoins a higher level of safety and decentralization can be achieved by the protocols.

Benefits of Protocol Native Stablecoins

Protocol native stablecoins can provide protocols with many benefits, depending on how they’re designed. Dopex’s DPXUSD creates stronger liquidity for the protocol since the stablecoin is minted from LP positions. It can also create better tokenomics for the protocol’s native token through giving it more utility within the ecosystem. Ultimately, protocols can design their own stablecoin depending on their needs and utility while also increasing decentralization.

Growing Market of Stablecoins

Stablecoins currently occupy 15% of the total cryptocurrency marketcap, and likely will continue to grow as both the broader industry but also the DeFi ecosystem grows. This makes having your own stablecoin a lucrative opportunity to capture a share of the growing market.

The Future of Stablecoins

To recap so far:

Centralized stablecoins currently occupy a large share of stablecoin in DeFi

Protocol native stablecoins exist (ex. sUSD), and are rising in popularity (ex. DPXUSD, crvUSD, GHO)

Risks of censorship from centralized stablecoins, the benefits of having a native stablecoin, and the opportunity to capture marketshare in a growing market are potential reasons for the rising trend

It is hard to say with certainty, but I believe this trend of protocol native stablecoins are here to stay and will become more dominant among DeFi protocols in the future. Having an entire ecosystem relying on a single stablecoin has a large risk, whether it be the risk of censorship or even collapse (ex. the Terra ecosystem after the UST depeg).

However, there are still issues that will come from the fragmentation of liquidity by having multiple stablecoins. Less liquidity makes the stablecoin less reliable when there are large swaps and make them more susceptible to depegging. This will require protocols to invest (either directly or through incentives) to create deep liquidity for their stablecoin. Either way, the future of stablecoins will certainly be interesting as new models and applications for them arise.

Thanks for reading.

Special thanks to YoniJMel and CryptoCondom for their help in this article :)