The Kill Bill: What the Future Holds for Stablecoins

Table of Contents:

Introduction

What is the bill?

Contents

How close is to being passed?

What does this means for current stablecoins?

Centralized stablecoins

FRAX

Overcollateralized stablecoins (DAI, LUSD, MIM)

The future of stablecoins

How stablecoins will have to change

New innovation of stablecoins

Conclusion

Introduction

Crypto is no stranger to regulatory bills entering the House attempting to gain control over our digital assets. Today, a draft bill in the House of Representative was released, focused on regulating stablecoins, specifically impacting issuers and and the collateralization of stablecoins. Stablecoins as an aggregate are the third largest crypto asset, almost as large as Ethereum with a market cap of $152.8b.

Will this bill kill one of the largest crypto asset type? What does this mean for the current and future stablecoins?

What is the bill?

(Main sources from The Block and Bloomberg)

Contents

The main point of the bill is introducing a framework around who can issue stablecoins and how they can issue them. Stablecoins will need to be “fully backed by cash or highly liquid assets”, what classifies as a “highly liquid asset” is still unknown but includes US Treasury bills. Issuers of stablecoins, which includes banks and nonbanks, will need to be approved with penalties being up to 5 years in prison and 1 million dollars in fines.

A two-year grace period will be put in place for current stablecoins for them to comply with the bill. It will also be illegal to create a “endogenously collateralized stablecoins”, likely meaning a stablecoin that is collateralized by a token within its existing ecosystem (eg. creating a UST-LUNA type stablecoin).

How close is it to being passed?

Generally, there is a 5 step process to these bills, 1) introduced, 2) pass senate, 3) pass house, 4) go to president, and 5) become law. This bill is in phase 0 and hasn’t even been officially introduced yet. This bill is still extremely new and will likely experience multiple revisions before moving on to the next phase.

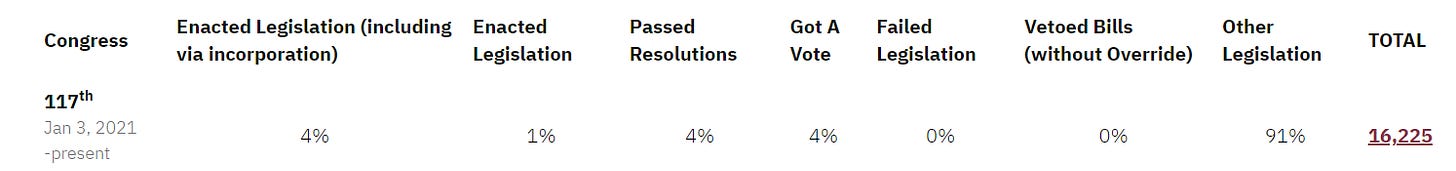

Wen bill? Not soon. For context, the Lummis-Gillibrand Responsible Financial Innovation Act that caused a ruckus on CT was first introduced in June… and still hasn’t passed senate yet (step 2/5). Multiple hearings are held before the first vote is made. Since January 3, 2021, only ~4% of bills have been made into law. So what are the chances this bill passes? Pretty low, especially in its current form.

But what if it does pass? No worries, anon. Keep reading.

What does this means for current stablecoins?

Centralized Stablecoins

The 3 largest stablecoins are all centralized and currently occupy 91% of the stablecoin market. USDT ($67.97b), USDC ($49.52b), and BUSD ($21.03b). Not only are they intrinsic to DeFi, most users hold their stables in these stables. So what risk does this bill pose to the super majority of stablecoins? Not much.

All three of these are fiat backed by a combination of cash, treasury bills, and other real world assets. This makes them already compliant with the current state of the bill, only requiring further approval.

FRAX

Why is FRAX so special that they get their own section? Well they’re the largest non-centralized and not overcollateralized stablecoin. With a market cap of $1.36b, FRAX is the 5th largest stablecoin (and largest algorithmic stablecoin).

A quick ELI5 of how FRAX works is that it is partially collateralized by USDC and FXS, their utility token. The collateralization ratio between USDC and FXS is adjusted algorithmically, depending on the price (demand) of FRAX. Currently, FRAX is at a 92.5% collateralization ratio, meaning 92.5% of the collateral backing FRAX is USDC.

If this bill is passed in Frax’s current form, it will be subject to scrutiny as it relies on an “endogenous” asset as collateral (FXS). However, FXS only makes up 7.5% of FRAX, and their founder, Sam Kazemian, has said that “we should simply take the CR to 100%. That will make the danger here 0%.” This means FRAX would be 100% collateralized by USDC (or perhaps a mix of USDC and assets like ETH), and thus would not be at risk of the bill.

Ok, so the bill is also (mostly) a non-problem for Frax, what about the rest of stablecoins?

Overcollateralized stablecoins (DAI, LUSD, MIM)

Overcollateralized stablecoins are one of the most common type of stablecoin for decentralized protocols. The 4th largest stablecoin, DAI, uses this model, as well as many other such as LUSD (14th largest) and MIM (12th largest). So how at risk are they? It all depends what is considered a “highly liquid asset.”

DAI is mainly collateralized by USDC, ETH, WBTC, and also RWAs (real world assets). If ETH and BTC are considered “highly liquid assets”, then DAI should be completely fine as well! What might lead to a bit of trouble is their RWAs. Through Centrifuge, MakerDAO has lent out ~40m DAI collateralized by things like real estate, real estate loans, and freight invoices. Are these “highly liquid assets”? Maybe not. But even if they aren’t, DAI will likely still be fine as RWAs make up a tiny percentage of DAI collateralization.

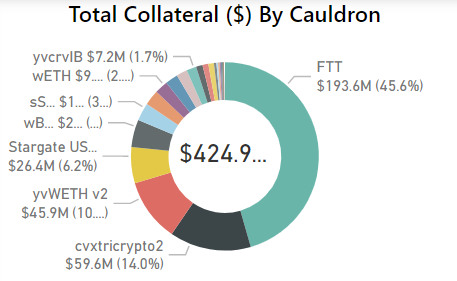

For MIM and LUSD, a similar story can be told. LUSD is fully collateralized by ETH. MIM is backed mostly by stables, ETH, wBTC, and FTT, all of which is probably “highly liquid”, except maybe not FTT. In the case that FTT is not considered highly liquid, MIM will likely be alright, they survived a multi-billion dollar collateral and supply drop due to the LUNA collapse.

The future of stablecoins

How stablecoins will have to change

The current largest stablecoins will likely have to do little to nothing in order to comply with this new bill. 95%+ of the stablecoin market cap are fully collateralized by either fiat, ETH, wBTC, or other stablecoins. In my interpretation of the law, they will all be fine. Perhaps some protocols will have to adjust their models (such as Frax), but I doubt it will have a large impact on the greater stablecoin market.

What I do believe this impacts is the potential new innovation of stablecoins.

New innovation of stablecoins

Novel models or innovations in stablecoin models will be stunted by the bill. It makes algorithmic stablecoins near impossible to create in the US without the fear of penalty. However, this does not mean no innovation can be made in stablecoins. For example, protocol level stablecoins such as GHO can still be created, as well as delta neutral stablecoins that rely on (highly liquid) perpetuals, such as UXD. This bill might mark the end of algostables in the US, but certainly does not mean the end of stablecoin innovation.

Conclusion

To summarize:

The stablecoin bill restrict stablecoin issuers in the US to be approved and fully backed by “highly liquid assets”

The bill is still in its extremely early stages, and will likely change a lot before finalization

Centralized stablecoins are already mostly compliant with this new bill

FRAX will have to make small adjustments to become compliant with the bill

Overcollateralized stablecoins will be fine, depending on the definition of “highly liquid”

The future of stablecoins will probably look similar to the current landscape, but the bill does stifle innovation, however it does not make it impossible

So what does this mean? This bill probably isn’t as bad as everyone was expecting for the vast majority of stablecoins. However, depending on how they define certain terms, most stablecoins will likely not need to change at all. I would expect more legislation like this to come to both crypto as a whole and stablecoins as a way to gain more control.

Thanks for reading.

Special thanks to Haym, Clonescody Dickson for their help in this article.